IR35 Compliance, Sorted.

Everything You Need To Get It Right — Whether You're an Experienced Contractor Or a Permanent Employee Looking To Explore Setting Up a Limited Company.

Overview

Since the 2021 off-payroll reforms, IR35 has shifted from a contractor’s concern to a hiring business’s legal responsibility. But whether you’re engaging contractors or working through a PSC, understanding how the rules apply to you is critical.

If you’re working through a PSC or considering contracting roles, understanding how IR35 applies is critical. It affects your take-home pay, tax liabilities, and how you operate.

That’s why we’ve created the IR35 Compliance Pack for Contractors — a clear, practical guide to help you:

Understand the rules

Protect your income

Avoid common pitfalls

Stay informed. Stay compliant.

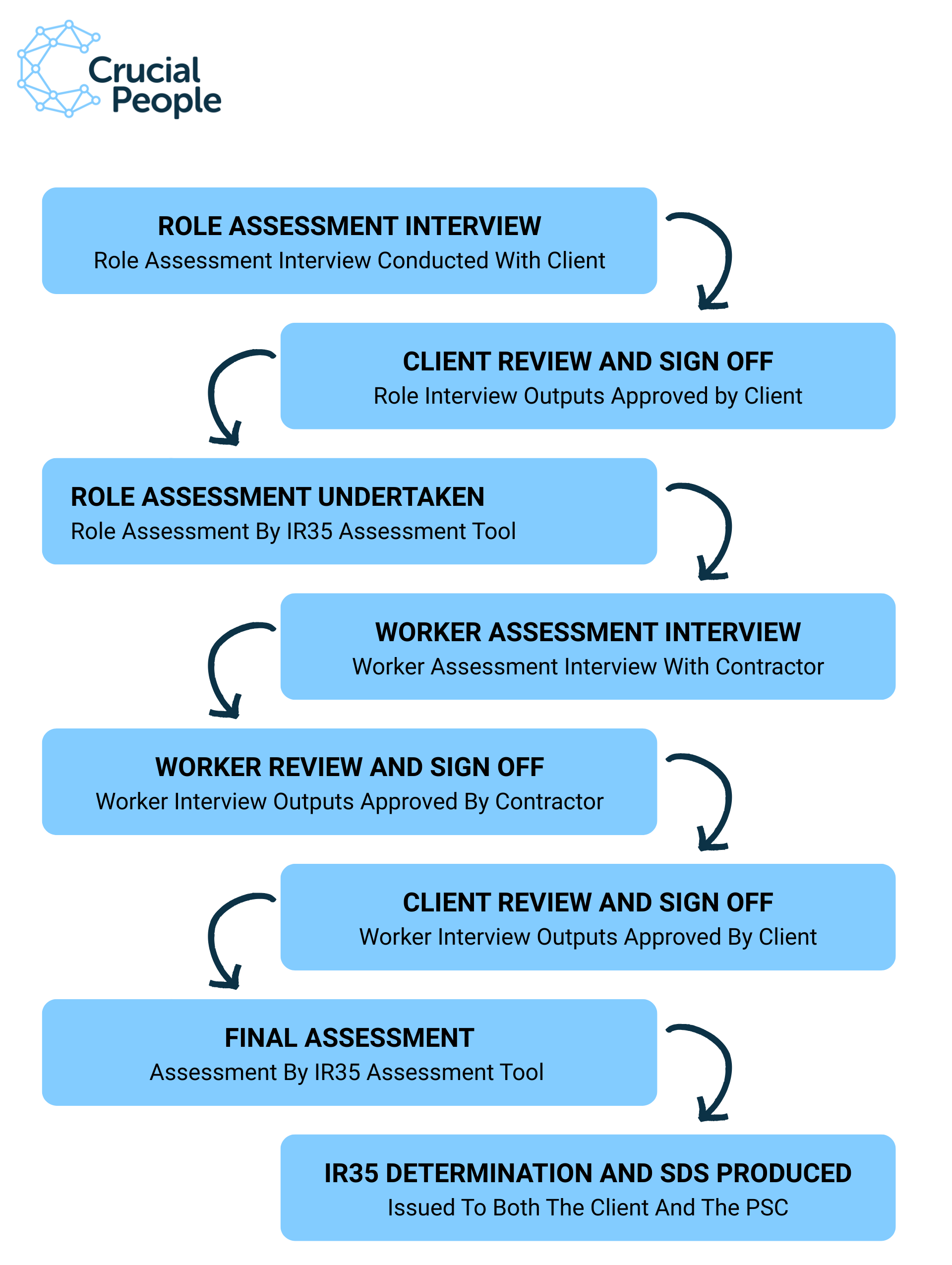

How do we work

We use an independent IR35 Review Tool to provide an unbiased assessment for each assignment and produce a compliant Status Determination Statement (SDS) — at no cost to our clients or contractors.

We manage the workflow. You stay compliant.

What's Inside the Pack?